- Published by:

- Department of Treasury and Finance

- Date:

- 1 Dec 2022

Hui Shi1 and Edward Jin2,3

1 Financial Frameworks Team, Budget Strategy Group, Budget and Finance Division.

2 Revenue Forecasting Team, Economic Division

3 Author contact details: veb@dtf.vic.gov.au

Acknowledgements: The authors would like to thank Andrew O’Keefe, Rebecca Valenzuela, Helen Ratcliffe and Teresa Stewart for providing detailed feedback on this paper.

Disclaimer: The views expressed in this paper are those of the authors and do not necessarily reflect the views of DTF.

Suggested Citation: Hui Shi and Edward Jin (2022) Valuing the costs of natural disasters using the life satisfaction approach. Victoria’s Economic Bulletin, December, vol 6, no 4. DTF.

Abstract

This paper applies the life satisfaction approach to estimate the cost of natural disasters in utility loss terms in Australia. In valuing the cost of natural disasters, the life satisfaction approach is shown to be a useful supplement to conventional approaches, which are largely unable to capture unobservable costs relating to people’s health and wellbeing.

Using a fixed-effects model with HILDA survey panel data conducted between 2009 and 2019, we find that experiencing damage from natural disasters has a negative impact on people’s life satisfaction and that the impact differs between men and women and between homeowners and non-homeowners. Using our estimates, we calculate that the detrimental effect of a natural disaster damaging an individual’s house is equivalent to a loss of $162,492 in household income.

The estimate provides no guidance on methods of compensation. In practice, compensation will take many forms and will largely be comprised of private insurance payouts. Our work contributes to the development of more holistic cost estimation for extreme weather events. Further research is warranted to establish reliable estimates of costs of natural disasters for application in other contexts.

1. Introduction

Natural disasters are becoming more frequent and intense due to climate change.

Australia has experienced higher temperatures and rising sea levels in recent years, with floods and bushfires being the most common disasters in the country.1 In February and March 2022, severe storms and flooding devastated both southeast Queensland and coastal New South Wales. By May 2022, the total incurred claims cost from this event was more than $3.35 billion,2 following the destruction to personal property and infrastructure and loss of life. Victoria has also been adversely affected by recent weather-related disasters – bushfires in 2019–20 damaged more than 1.5 million hectares of land in eastern Victoria.3

Natural disasters can cause enormous financial and personal loss, including loss of homes, damage to property, loss of livestock and farm produce as well as personal trauma and loss of life. Not surprisingly, the tangible costs of natural disasters are more easily accounted for than the intangible and hidden costs. Many costings therefore tend to underestimate the value of the total loss, reflecting that some of the costs are unobserved. For example, Wittwer et al. (2021) estimates that the direct cost of the 2019–20 bushfires on the Victorian economy was 0.1 per cent of gross state product, but this estimate does not account for the broader costs relating to the environment and people’s health and wellbeing.

The extent to which this value underestimates the true total cost is unknown; what is known is that the personal trauma and other intangible costs borne by the affected population are significant and can reduce economic returns in the region (Baryshnikova and Pham 2019).

In this paper, we aim to provide a more holistic approach to the costing of natural disasters by applying a life satisfaction approach. This approach circumvents the drawbacks of conventional approaches by using individual subjective wellbeing (SWB) to proxy for utility and using the link between SWB and income to derive costs. We contribute to the literature in three ways. First, our paper is among the first to use people’s life satisfaction responses to value the impact of natural disasters in Australia. While Carroll et al. (2009) and Frijter et al. (2011) employ a similar approach to estimate the costs of extreme events in Australia, their studies cover shorter periods (three and five years respectively) and are restricted to specific geographic locations. In this study, we use a significantly longer period (2009 to 2019) and look at all Australian states to provide more recent and comprehensive cost estimates of natural disasters.

Secondly, our analysis uses longitudinal data and panel techniques to overcome several data and methodological issues found in previous studies. One limitation from past studies is the need to draw data from two separate sources to define disaster experience. For example, Carroll et al. (2009) merges postcode information from the Australian Bureau of Meteorology and the Australian Centre on Quality of Life to obtain a disaster experience variable. Doing so introduces the risk of misidentifying information, since it cannot be confirmed whether an individual living in the region has been directly affected by the extreme weather condition. Instead, we use population representative longitudinal data from Australia, which provides more detailed information on an individual’s experience of natural disasters and records people’s self-reported life satisfaction. Furthermore, the survey asks individuals to identify damage experienced from any type of weather-related disasters in the past 12 months, which allows us to estimate the year-to-year effect of natural disasters.

Thirdly, we compare the effect of natural disasters on the life satisfaction of women and men and homeowners and non-homeowners. Our results highlight the importance of targeting policies towards different cohorts to better mitigate the impact of natural disasters. We hope to provide greater clarification on the direction of effects given the inconclusive and contrasting results in the economic literature (see for instance Kimball et al. 2006 and Yamamura 2012).4

The remainder of the paper is organised as follows: Section 2 discusses the use of SWB as a proxy for utility to value the cost of natural disasters, Section 3 introduces the empirical methodology and describes the data, Section 4 discusses regression results and quantifies the costs of natural disasters and Section 5 concludes.

Footnotes

[1] State of Climate 2020(opens in a new window), CSIRO and the Bureau of Meteorology.

[2] Insurance Council of Australia (2022). Climate change impact series: Flooding and future risks.

[3] 2019–20 Eastern Victorian bushfires.

[4] Kimball et al. (2006) finds that the severe damage from Hurricane Katrina significantly reduced affected people’s happiness. In contrast, Yamamura (2012) finds that surviving the Kobe earthquake had a long-lasting positive effect on a survivor’s subjective wellbeing. The author owes this peculiar result to survivors feeling more fortunate following the deaths of their neighbours, lowering their aspiration levels.

2. Conceptual framework

Unlike marketable goods, the value of which can be inferred from observed market data, the characteristics of public goods prevent people from disclosing their true demand for them.

Given that natural disaster prevention measures have the characteristics of a public good, economists and actuaries conventionally measure their value through either a revealed preference approach or a stated preference approach.1

Using a revealed preference approach, costs are estimated by observing individuals’ perceived ability to substitute between a public and a private good. In our particular case, using a revealed preference approach you can infer the value of disaster prevention measures from how much people are willing to pay for them, as if they were private goods. The derived values are then used to help design risk transfer mechanisms, such as insurance premiums, which are offered to the public. Individuals’ willingness to pay for disaster prevention measures depends on their expectations of how these measures will affect their utility. Because these expectations are commonly flawed where risks are complex or not well-understood, this method can understate or overstate demand for prevention measures (Luechinger and Raschky 2009). For example, Troy and Room (2004) finds no price discounts for houses located within a hazard zone before the passage of a state’s natural hazard disclosure law, but a large price discount thereafter.

Using a stated preference approach, individuals are directly asked to disclose their demand for natural disaster prevention through carefully designed surveys using hypothetical markets. However, this approach can be cognitively demanding for participants and may produce unreliable results. In a study of a flood reduction project in the United States, 15 per cent of the respondents could not attach a monetary figure to the project, although its characteristics had been carefully described to respondents in interviews only two years after a major flood occurred (Thunberg and Shabman 1991).

Our study provides an alternative approach that addresses the weaknesses of the conventional methods described above. Specifically, we use subjective wellbeing data to derive cost estimates of natural disaster impact. Kahneman et al. (1997) was the first study to provide a rationale for life satisfaction measures in economic analysis. This study was also the first to show that life satisfaction can be an adequate empirical approximation of experienced utility, where this is measured by considering respondents’ answers to life satisfaction questions in pre- and post-event surveys. Experienced utility is distinguished from decision utility, which is a representation of preferences over choices. Kahneman and others relate experienced utility to hedonic experience, which can be reported in real time or in retrospective evaluations of past episodes. Literally, experienced utility refers to ‘enjoying’ while decision utility refers to ‘wanting’. They argue that experienced utility is not only measurable but also of fundamental importance for understanding individuals’ behaviour and selecting public policies.

As described above, revealed and stated preference methods generally refer to decision utility. For instance, people’s willingness to pay for avoiding a natural hazard, which reveals their valuation of disaster prevention measures, depends on their expectations as to how those measures will increase their utility. Likewise, people’s stated willingness to pay for preventative measures depends on their expectation of the utility of those measures. To capture the value of non-market goods, both revealed and stated preference methods require that individuals can accurately predict the utility of their choices.

Using survey data on SWB to value non-market goods does not rely on individuals’ choices, but on the statistical associations between individual SWB and indicators of non-market goods,2 and between SWB and income. We note here that the concept of SWB encompasses both happiness and life satisfaction and that SWB, happiness and life satisfaction are highly correlated with each other as they yield the same qualitative insights (Frey and Stutzer 2002). In practice, reported SWB can serve as an empirically adequate proxy for an individual’s experienced utility as (i) it reflects the individual’s global evaluation of their life, (ii) it reflects both stable inner states and current affects and (iii) respondents’ evaluations refer to present life, i.e. to flow-utility (Luechinger and Raschky 2009). On a technical note, it is standard practice to impose modelling assumptions in the empirical exercise. One of the key assumptions presumes that a positive monotonic relationship exists between SWB and the underlying true utility, which means that for an individual i at times t and s, if SWBit > SWBis, then his or her utility will be Uit > Uis. A second standard assumption employed pertains to the ordinal interpersonal comparability of the SWB level: that is if SWBit > SWBjt, then for individuals i and j.3

Economists have used this subjective wellbeing approach to measure the wellbeing impacts of events such as inflation and unemployment (Di Tella et al. 2001), inequality (Alesina et al. 2004), terrorism (Frey et al. 2009; Metcalfe et al. 2011), civil war (Welsch 2008a) and corruption (Welsch 2008b). Several subsequent studies have now established a clear link between major life events such as marriage, divorce, disability, unemployment and financial shocks on life satisfaction (Lucas and Clark 2006; Oswald and Gardner 2006; Oswald and Powdthavee 2008; Lucas et al. 2004; Di Tella et al. 2010). For natural disasters, using self-reported wellbeing metrics has been shown to be an effective alternative to measuring the full impact of extreme events. Frijters and Van Praag (1998) uses life satisfaction data in Russia in 1993 and 1994 to predict the costs of climate change. Luechinger and Raschky (2009) uses life satisfaction data in Europe between 1973 and 1998 to estimate the costs of floods. More recently, in Japan, Rehdanz et al. (2015) uses the same approach to find that the decrease in happiness in survivors exposed to the Fukushima nuclear disaster in 2011 is equivalent to a 72 per cent reduction in annual income. In Australia, Carroll et al. (2009) finds that a decline in life satisfaction from spring droughts corresponds to an annual income loss of $18,000.

Footnotes

[1] Public goods have two distinct aspects: non-excludability and non-rivalry, implying when individuals make decisions about buying a public good, a free rider problem can arise, in which people have an incentive to let others pay for the public good and then to ‘free ride’ on the purchases of others.

[2] In the case of natural disasters, the indicators could be frequency or severity of a disaster.

[3] Ferrer-i-Carbonell and Frijters (2003) discusses these assumptions in greater detail.

3. Methodology and data

The two key elements of this study are (i) the life satisfaction approach that we employ in the derivation of total costs and (ii) the longitudinal dataset that we use in the empirical analysis.

In what follows, we first provide details of the empirical methodology underlying our SWB approach, followed by a detailed discussion of the data with some summary statistics.

3.1 Empirical methodology

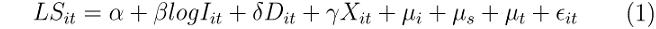

To apply the life satisfaction approach, we consider the following fixed effect model to estimate the impact of experiencing house property damage from a natural disaster on SWB for an individual:

where LSit is level of life satisfaction of individual i in year t and Iit is individual i’s annual household income. The natural logarithm of household income (log I) enters the regression equation to account for declining marginal utility of income.

Dit indicates whether individual i experienced home damage from natural disasters in year t. Xit is a vector of variables controlling for personal characteristics, such as age, household size, education level, health status, employment status, marital status, number of children, living areas (urban or rural), and health-related behaviour. μi denotes the unobservable time-invariant individual factor. μs and μt are state and year fixed effects, which are dummy variables respectively representing the state the individual resides in and the year of the interview. εit denotes the unobservable disturbance term.

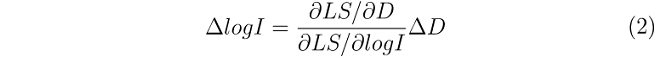

Wellbeing regressions like equation (1) have been commonly used as a valuation tool for non-market goods. The estimated coefficients that link life satisfaction, income and natural disaster experience allow one to calculate the monetary equivalent of the utility loss from experiencing a natural disaster. Specifically, we use the estimated coefficient on log household income (β) together with the coefficient on the damage from disaster (δ). That is, the total cost of a natural disaster is the amount of log income required to compensate an individual to reach the same level of life satisfaction if they were to experience the natural disaster. In other words, we estimate the monetary transfer an individual (who has experienced natural disaster) would need to receive to return to their life satisfaction level before the event, otherwise known as the ‘compensating variation’.

If life satisfaction (LS) depends on the income (I) and disaster damage (D), holding everything else constant, then the amount of log income required to compensate for disaster damage (∆LS=0), will be:

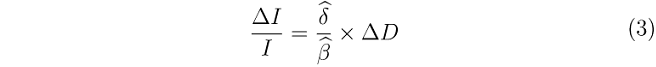

Based on regression results from (1), we can calculate the amount of income compensated as:

Intuitively, the severity of damage inflicted by natural disasters will require differing amounts of compensation for different individuals and households. As such, the accuracy of our costing will be highly dependent on the detail of damage experience available in the dataset. Unfortunately, data from the survey used can only indicate whether respondents have or have not suffered damage – a constraint that threatens to severely limit the ability of our approach to estimate the utility loss associated with different extents of damage. To partially overcome this, we make some assumptions on the probability that an individual will suffer from home damage from a natural disaster. For example, we could assume that the potential risk for disaster damage is reduced due to preventative measures (∆D) by a percentage ranging from 0 to 100.

3.2 Data

In this study, we use a population-representative longitudinal dataset, the Household, Income and Labour Dynamics in Australia (HILDA) survey. The HILDA survey is an annual household-based survey which collects a comprehensive set of panel information on people’s socioeconomic characteristics, wellbeing and family circumstances. The survey tracks more than 17,000 Australians each year, starting from 2001 when the survey was first conducted. Information collected includes responses to questions about experiences from any type of weather-related natural disaster in the past 12 months, which allows us to estimate the year-to-year effect of natural disasters. Information related to weather-related disaster events, such as floods, bushfires and cyclones, is available from wave 9 in 2009 onwards. This gives us 11 waves of HILDA data from 2009 to 2019 that we can use in our analysis. From here, we built a balanced dataset across 11 years, covering 41,962 observations from 13,085 households across eight states and territories.

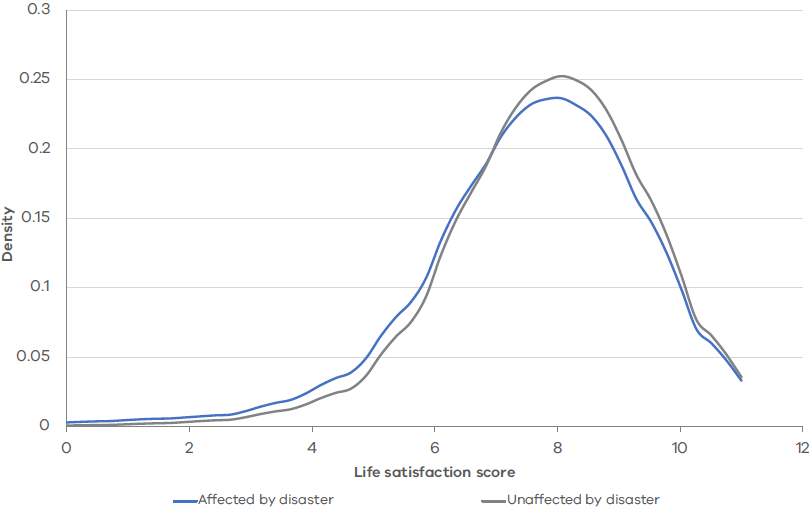

The dependent variable, respondents’ self-reported life satisfaction, is the categorical response to the following question: how satisfied are you with your life? The respondent chooses a number on a scale from 0 to 10, where 0 means completely dissatisfied and 10 means completely satisfied. Figure 1 shows the density functions of life satisfaction for different cohorts. A visual inspection suggests that the cohort affected by natural disasters has a slightly lower average life satisfaction score than the cohort not affected.

Figure 1: Distribution of life satisfaction scores

To calculate the compensating variation, information on the two explanatory variables is extracted. The first variable, disaster experience, is obtained from the question: has a weather-related disaster (e.g. flood, bushfire, cyclone) damaged your house? The responses are further separated by gender and home ownership status in our analysis. For the second variable, income, we use respondents’ annual household income, defined as the sum of all household members’ gross income for each financial year.

Table 1 compares the means for life satisfaction score and main control variables for the different cohorts:

(i) between people who have experienced damage from natural disasters and those who have not

(ii) between homeowners and non-homeowners.

For cohorts grouped by experience, individuals who have experienced natural disasters, on average, have lower satisfaction, income and education. They are also more likely to be unemployed and to suffer from longer term health problems. For cohorts grouped by home ownership status, the summary statistics show homeowners feel more satisfied with their lives and have higher levels of income and education. Furthermore, homeowners appear to be healthier in the long term, with responses that indicate they smoke less and consume less alcohol than their counterparts who rent or board.

Table 1: Descriptive statistics for different cohorts

| VARIABLE | DISASTER EXPERIENCE | HOME OWNERSHIP | |||||||

|---|---|---|---|---|---|---|---|---|---|

| TOTAL | YES (M0) | NO (M1) | DIFF(a) | YES (M0) | NO (M1) | DIFF | |||

| Life satisfaction(b) | 7.849 | 7.615 | 7.853 | 0.238 | *** | 7.944 | 7.521 | -0.423 | *** |

| Household income ($1 000) | 133.105 | 122.966 | 133.262 | 10.296 | ** | 144.929 | 92.005 | -52.924 | *** |

| Household size | 2.858 | 2.793 | 2.859 | 0.067 | 2.951 | 2.535 | -0.417 | *** | |

| Age | 50.228 | 50.686 | 50.221 | -0.465 | 51.508 | 45.780 | -5.727 | *** | |

| Tertiary education+ | 0.311 | 0.262 | 0.312 | 0.050 | *** | 0.333 | 0.235 | -0.098 | *** |

| Long-term health problem(c) + | 0.213 | 0.268 | 0.212 | -0.056 | *** | 0.198 | 0.266 | 0.068 | *** |

| Employed+ | 0.886 | 0.839 | 0.886 | 0.047 | *** | 0.915 | 0.787 | -0.128 | *** |

| No. of children | 1.958 | 2.147 | 1.955 | -0.192 | *** | 2.012 | 1.803 | -0.198 | *** |

| Married+ | 0.624 | 0.604 | 0.624 | 0.021 | 0.705 | 0.344 | -0.361 | *** | |

| Living in urban area+ | 0.886 | 0.796 | 0.887 | 0.092 | *** | 0.891 | 0.867 | -0.025 | *** |

| Smoking++ | 1.681 | 1.768 | 1.680 | -0.088 | *** | 1.610 | 1.928 | 0.318 | *** |

| Drinking alcohol+++ | 5.337 | 5.315 | 5.337 | 0.022 | 5.325 | 5.377 | 0.052 | ** | |

Notes:

(a) Difference between the mean value in two groups.

(b) Life satisfaction scores are self-rated, with scores ranging from 0 (completely dissatisfied) to 10 (completely satisfied).

(c) Self-reported binary response – with or without long-term health problems.

*** is significant at 1% level, ** at 5% level, and * at 10% level.

+ Binary; Base variables are without Bachelors degree, no long-term health problem, unemployed, single, rural.

++ Self-reported level ranges from 1 (never smoked) to 5 (smoke daily).

+++ Self-reported level ranges from 1 (never drunk alcohol) to 8 (drink alcohol everyday).

Table 2 reports the descriptive statistics across the waves. The sample means of the variables remain stable across the 11 years of data. Life satisfaction marginally increased over time, while the probability of experiencing a natural disaster fluctuated between 2009 and 2019, with a sharp decline in 2014. Average annual household income steadily increased by around 4 per cent a year while household size remained steady. It appears there was a steady increase in the number of people each year who obtained higher levels of educational qualifications, but employment rates in this sample cohort remained the same. It further appears that there was stronger preference for having children over the period, but fewer people were married, fewer were smoking and fewer were drinking alcohol.

Table 2: Descriptive statistics across waves

| VARIABLE | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Life satisfaction(a) | 7.816 | 7.754 | 7.833 | 7.809 | 7.802 | 7.814 | 7.817 | 7.833 | 7.806 | 7.832 | 7.870 |

| Disaster experience | 0.014 | 0.016 | 0.033 | 0.015 | 0.015 | 0.007 | 0.017 | 0.012 | 0.014 | 0.013 | 0.011 |

| Homeowner+ | 0.766 | 0.765 | 0.786 | 0.770 | 0.766 | 0.770 | 0.795 | 0.777 | 0.777 | 0.780 | 0.795 |

| Household income ($1 000) | 116.794 | 118.932 | 128.675 | 132.692 | 137.891 | 141.227 | 147.295 | 148.168 | 151.750 | 158.649 | 164.190 |

| Household size | 3.032 | 2.998 | 2.984 | 2.973 | 2.966 | 2.950 | 2.930 | 2.924 | 2.905 | 2.912 | 2.879 |

| Age | 45.832 | 46.165 | 47.002 | 47.314 | 47.862 | 48.506 | 48.976 | 49.631 | 50.332 | 50.913 | 51.399 |

| Tertiary education+ | 0.305 | 0.309 | 0.333 | 0.315 | 0.318 | 0.329 | 0.345 | 0.328 | 0.337 | 0.339 | 0.350 |

| Long-term health problem(b) + | 0.173 | 0.179 | 0.166 | 0.180 | 0.188 | 0.188 | 0.178 | 0.188 | 0.180 | 0.190 | 0.182 |

| Employed+ | 0.883 | 0.885 | 0.910 | 0.885 | 0.877 | 0.882 | 0.912 | 0.875 | 0.898 | 0.890 | 0.907 |

| No. of children | 1.870 | 1.878 | 1.881 | 1.910 | 1.916 | 1.936 | 1.899 | 1.959 | 1.983 | 1.996 | 1.928 |

| Married+ | 0.634 | 0.631 | 0.639 | 0.628 | 0.627 | 0.624 | 0.635 | 0.622 | 0.623 | 0.626 | 0.629 |

| Living in urban area+ | 0.877 | 0.886 | 0.890 | 0.886 | 0.887 | 0.887 | 0.896 | 0.888 | 0.886 | 0.886 | 0.890 |

| Smoking++ | 1.726 | 1.723 | 1.700 | 1.694 | 1.679 | 1.691 | 1.663 | 1.666 | 1.659 | 1.653 | 1.634 |

| Drinking alcohol+++ | 5.457 | 5.402 | 5.420 | 5.432 | 5.404 | 5.397 | 5.414 | 5.360 | 5.374 | 5.326 | 5.359 |

Notes:

(a) Life satisfaction scores are self-rated, with scores ranging from 0 (completely dissatisfied) to 10 (completely satisfied).

(b) Self-reported binary response – with or without long-term health problems.

+ Binary; Base variables are no disaster experience, non-homeowner, without Bachelors degree, no long-term health problem, unemployed, single, rural.

++ Self-reported level ranges from 1 (never smoked) to 5 (smoke daily).

+++ Self-reported level ranges from 1 (never drunk alcohol) to 8 (drink alcohol everyday).

4. Discussion of results

In this section, we report the modelling results of how life satisfaction is impacted by the experience of natural disasters.

In our modelling, we include income and other covariates that have been identified in the literature as important factors. We report results for the full sample and for males, females, homeowners and non-homeowners separately.

Our findings show that exposure to a natural disaster in Australia has a negative and statistically significant effect on reported life satisfaction. This result is consistent with the findings from Carroll et al. (2009) on the impact of Australian droughts and Luechinger and Raschky (2009) on the impact of floods in Europe. On average, a person who had experienced home damage from natural disasters in the past 12 months reported a 0.094 point lower life satisfaction score on the 10-point scale compared to the reference group. This is a net adverse effect of natural disasters which already captures the counter effects of some ‘resilience’ factors such as higher income, increased financial security or better health outcomes.

Experiencing home damage from a natural disaster would need to be compensated by changes in other personal circumstances for an individual to remain at the pre-disaster level of life satisfaction. From the entire sample, we identify other determinants to life satisfaction. As expected, life satisfaction is positively related with household income growth, improved long-term health and being employed.

Owning a home and being married also increases life satisfaction. Interestingly, we do not find a positive link between higher education levels and life satisfaction.

4.1 Gender difference

Natural disasters impact the life satisfaction of women and men differently. To show that, we split the full sample into women and men and estimate the results separately for the two groups. We find that natural disaster experience had a larger impact on women than men. Among the individuals who went through natural disasters, women experienced a 0.113 point decrease in life satisfaction while men experienced a 0.064 point decline. However, the effect on men is not statistically significant.

This result is consistent with findings in the wider economic literature. Emerson (2012), Hazelegar (2013), Prada (2015), Thurton et al. (2021) all demonstrate that women and girls bear a disproportionate burden of disaster-related impacts. The gender difference in wellbeing impact that we observe likely reflects the higher level of disaster vulnerability of Australian women compared to Australian men. This is thought to be directly related to their relatively poor rate and level of access or control of key economic resources (ABS Gender Indicators, Workplace Gender Equality Agency reports). These key resources in disaster, namely, a secure income, access to savings or credit, employment with social protection, marketable job skills, education and training, and control over productive resources, all help shape the way men and women prepare for, react to, are impacted by and recover from disasters.

On the other hand, Australian policy on disaster recovery support has been gender blind. Hazelegar (2013) shows that economic recovery often targets relief funds to male-dominated employment areas such as construction and landscaping. For a specific example, we cite the work of Alston (2009) which argues that the federal and state governments’ emergency support measures for drought discriminated against women in rural Australia as the policies treated family farming as a unitary male pursuit. In such instances, it is evident that men have indirectly benefitted more from disaster recovery plans.

Table 3: Impact of disaster experience on life satisfaction score

| VARIABLE | FULL SAMPLE | FEMALE ONLY | MALE ONLY | HOMEOWNERS ONLY | NON-HOMEOWNERS ONLY | |

|---|---|---|---|---|---|---|

| Disaster experience | -0.094** | -0.113** | -0.064 | -0.091** | -0.210* | |

| (0.041) | (0.057) | (0.059) | (0.043) | (0.116) | ||

| Log household income | 0.077*** | 0.090*** | 0.065*** | 0.069*** | 0.080*** | |

| (0.012) | (0.018) | (0.017) | (0.013) | (0.031) | ||

| Household size | 0.022 | -0.096** | 0.128*** | -0.014 | 0.109 | |

| (0.030) | (0.044) | (0.040) | (0.035) | (0.071) | ||

| Age | -0.007 | -0.085** | 0.075* | -0.009 | 0.009 | |

| (0.028) | (0.041) | (0.039) | (0.031) | (0.069) | ||

| Age square | 0.000*** | 0.000** | 0.000*** | 0.000*** | 0.000 | |

| (0.000) | (0.000) | (0.000) | (0.000) | (0.000) | ||

| Tertiary education | -0.031 | 0.036 | -0.140 | -0.041 | 0.033 | |

| (0.072) | (0.097) | (0.108) | (0.094) | (0.135) | ||

| Long-term health problem | -0.153*** | -0.167*** | -0.135*** | -0.111*** | -0.286*** | |

| (0.017) | (0.024) | (0.024) | (0.018) | (0.042) | ||

| Employed | 0.215*** | 0.095*** | 0.459*** | 0.148*** | 0.350*** | |

| (0.022) | (0.028) | (0.038) | (0.026) | (0.046) | ||

| No. of children | -0.107*** | -0.079** | -0.132*** | -0.100*** | -0.098** | |

| (0.020) | (0.032) | (0.026) | (0.024) | (0.048) | ||

| Married | 0.134*** | 0.124*** | 0.142*** | 0.142*** | 0.091 | |

| (0.027) | (0.038) | (0.038) | (0.032) | (0.068) | ||

| Homeowner | 0.104*** | 0.107*** | 0.095*** | |||

| (0.022) | (0.032) | (0.031) | ||||

| Living in urban area | -0.003 | -0.035 | 0.020 | 0.060 | -0.139 | |

| (0.050) | (0.069) | (0.073) | (0.079) | (0.098) | ||

| Smoking | 0.001 | -0.016 | 0.015 | 0.010 | -0.023 | |

| (0.013) | (0.020) | (0.017) | (0.015) | (0.028) | ||

| Drinking alcohol | 0.001 | 0.006 | -0.008 | 0.007 | -0.010 | |

| (0.004) | (0.005) | (0.006) | (0.004) | (0.009) | ||

| Constant | 5.503*** | 8.887*** | 1.639 | 5.687*** | 4.442 | |

| (1.391) | (1.969) | (1.954) | (1.564) | (3.098) | ||

| Individual fixed effects (FEs) | Yes | Yes | Yes | Yes | Yes | |

| State FEs | Yes | Yes | Yes | Yes | Yes | |

| Observations | 35 747 | 18 905 | 16 842 | 27 730 | 8 017 | |

| R-squared | 0.014 | 0.013 | 0.024 | 0.011 | 0.027 | |

| Number of id1 | 4 484 | 2 434 | 2 050 | 3 843 | 1 607 | |

Notes:

*** is significant at 1% level, ** at 5% level, * at 10% level.

4.2 Home ownership

Recent studies in subjective wellbeing have identified a strong positive relationship between life satisfaction and home ownership – with homeowners at all levels of income exhibiting higher levels of satisfaction compared to those who rent or do not own their homes. This can be seen in, for example, Zumbro (2014) for Germany, Zhang (2018) and Ren, et al. (2018) for China, and Dockery and Bawa (2019) for Australia. Valenzuela, et al. (2014) further identifies that home ownership is an important element in reducing the gap in relative welfare levels between households in Australia.

Therefore, it is worth understanding if and how homeowners and non-homeowners are affected differently by having their homes damaged in natural disasters. To measure this, we partitioned the population into homeowners and non-homeowners and applied our model separately to each group to uncover any systematic differences in the results. Results are presented in the last two columns of Table 3. For homeowners, our analysis shows that experiencing house damage from a natural disaster will reduce life satisfaction by 0.091 points. The negative impact is much larger for non-homeowners, with a 0.210-point reduction in life satisfaction. At face value, this implies that the impacts of natural disaster accrue more to non-homeowners than they do to homeowners, but why this is so may be more complex than can be immediately surmised.

First, the social and economic profiles for homeowners and non-homeowners are very different. Homeowners tend to be older, have higher incomes and have homes that are larger and/or better quality. In contrast, non-homeowners tend to be younger, have less work experience and have lower income levels on average (see Table 1 for cohort information). Results from Dockery and Bawa (2019) suggest that homeowners tend to have higher levels of life satisfaction as a result of their higher financial and social security, in part due to the benefits of residential stability and greater community engagement. Furthermore, the study finds that homeowners have better physical and mental health outcomes than non-homeowners. The precise explanation of why we observe greater negative effects accruing to non-homeowners will need to be investigated more systematically to reach a definitive conclusion. From what we can infer here, our findings suggest that people with greater assets/tenure security have higher economic resilience.

4.3 Quantifying costs of natural disasters

In this section, we translate our results to dollar values for any losses incurred or gains realised as indicated by our modelling exercise above. In particular, we use the estimated coefficients for disaster experience (δ) and income (β) to approximate an individual’s compensating variation, or their willingness to pay (WTP) to avoid a natural disaster (∆D). The resulting figure will be tantamount to the full cost compensation due to the individual post-disaster, if we were to restore their life satisfaction and wellbeing to pre-disaster levels.

To achieve this, we consider two situations:

(i) a reduction of the probability of a damage from 1.5 per cent to 0 per cent, that is, ∆D=0.015, by assuming that the likelihood of a potential risk for a disaster damage is 1.5 per cent2

(ii) a complete avoidance of damage from a natural disaster, which implies ∆D = 1.

To compute, we apply equation (3) and use the sample’s average annual household income over 11 years, which is $133,105. The calculated compensations are presented in Table 4. The associated estimated compensation for the prevention of certain house damage from a natural disaster for Australians is $162,492 (in 2019 Australian dollars). This is an estimate of the maximum amount the average Australian is willing to pay to avoid a disaster event, given that the income level and other parameters are unchanged. For a reduction of the probability of a natural disaster by 1.5 per cent, it is estimated that the average individual would be willing to pay $2,437 or 1.8 per cent of annual household income.

Table 4: Quantified costs of natural disasters (in 2019 Australian dollars)

| Amount of income an individual is willing to pay for | Absolute | In per cent |

|---|---|---|

| (a) Decrease in probability of home damage from a natural disaster by 1.5 per cent | $2,437 | 1.8% |

| (b) Prevention of damage from a natural disaster | $162,492 | 122% |

Note: Values were computed based on an annual household income of $133,105 which is the sample’s annual average income over 11 years.

We compare our results to other studies using similar approaches. Luechinger and Raschky (2009) estimates that the average WTP for the prevention of floods in the affected regions of residence in Europe and the United States is $6,505 (in 2004 U.S. dollars) or 23.7 per cent of an average household income. For a 2.6 per cent decrease in the likelihood of annual flood, an individual would be willing to pay $195 (about 0.7 per cent of their annual household income). In estimating the cost of the 2002 drought, Carroll et al. (2009) finds each quarterly drought is equivalent to the loss of $18,000 (in 2001 Australian dollars) in household income.

Our total cost estimate for natural disasters is considerably higher than the above two studies. There are a number of potential explanations for this discrepancy. Firstly, in our study, the type of natural disaster is not specified, suggesting natural disasters that are not evaluated in the above two studies, such as bushfires, may require different monetary compensation. Secondly, we define natural disaster experience as when a respondent has had their house damaged by a disaster. In contrast, the two earlier studies represent disaster experience as whether the individual resided in the region in which the disaster occurred. Hence, the intangible cost estimates will be greater in our analysis as we solely focus on individuals confirmed to have suffered damages from a disaster. Thirdly, the data frequency of our study differs from the two earlier studies, resulting in different present value of an averted natural disaster in life satisfaction terms. Data on disaster experience and life satisfaction used in our study were collected on a yearly basis. However, estimates in Luechinger and Raschky (2009) were based on the survey question over an 18-month period while Carroll et al. (2009) used data collected on a quarterly basis. Further research based on better quality data is warranted to obtain more reliable estimates of costs for natural disasters.

Footnotes

[1] This represents people who responded in all 11 waves in our balanced dataset.

[2] The probability of natural disasters during the period 2009 to 2019 ranging from 0.7 per cent to 1.5 per cent.

5. Conclusion

In this paper we use life satisfaction survey data to estimate the full costs of natural disasters.

Relying on the HILDA survey, which contains information on respondents’ global evaluation of their present life, we apply a fixed-effects model to estimate the impacts of experiencing house damage from natural disasters on individual life satisfaction. In identifying the coefficient estimates from the regression that link life satisfaction, income and natural disaster experience, we calculate the compensating variation for experiencing a natural disaster in Australia.

In our analysis, we have found that experiencing damage from natural disasters reduces a person’s life satisfaction score by 0.094 points (on the 10-point scale). We have also considered gender differences. The life satisfaction score of women who have experienced damage from a natural disaster is 0.113 points lower than that of other women. The negative impact for men is not statistically significant. We have further investigated the differentiated effect of disaster experience for homeowners and non-homeowners. We have found that the negative impact of damage from natural disasters on non-homeowners’ life satisfaction score (-0.210 points) is more than twice as much as the impact on homeowners (-0.091 points). Our findings add evidence in support of targeted disaster recovery efforts for different cohorts.

We use the estimated coefficients and annual household income to calculate the implicit WTP for a reduction in risk of natural hazards. If the likelihood of damage from natural disasters reduces by 1.5 per cent, the average WTP for the prevention is $2,437. However, if damage from an otherwise certain natural disasters can be completely avoided, the estimated WTP is $162,492. These estimates provide no guidance on how to compensate for the effects of a natural disaster. In practice, compensation would take many forms and would be largely comprised of private insurance payouts.

Ultimately, our life satisfaction approach presents a supplementary tool for valuing non-market goods. This is particularly relevant when inadequate information or market restrictions prevent the disclosure of a public good’s true value. By contributing to the development of more holistic cost estimation methods, we hope to ultimately assist policymakers in designing disaster support measures to respond to the increasing prevalence of extreme weather events.

6. References

References for this Victoria’s Economic Bulletin research article.

Alesina A, Di Tella R, and MacCulloch R (2004) ‘Inequality and happiness: Are Europeans and Americans different?’, Journal of Public Economics, 88(9-10), 2009-2042.

Alston M (2009) ‘Drought policy in Australia: Gender mainstreaming or gender blindness?’, Gender, Place & Culture, 16(2), 139-154.

Baryshnikova N, and Pham NT (2019) ‘Natural disasters and mental health: A quantile approach’, Economics Letters, 180(C), 62-66.

Bradshaw S (2015) ‘Engendering Development and Disasters’, Disasters, 39. s54-s75.

Carroll N, Frijters P, and Shields MA (2009), ‘Quantifying the costs of drought: New evidence from life satisfaction data’, Journal of Population Economics, 22(2), 445-461.

Di Tella R, MacCulloch RJ, and Oswald AJ (2001) ‘Preferences over inflation and unemployment: Evidence from surveys of happiness’, American Economic Review, 91(1), 335-341.

Di Tella R, Haisken-De New J, and MacCulloch R (2010) ‘Happiness adaptation to income and to status in an individual panel’, Journal of Economic Behavior & Organization, 76(3), 834-852.

Dockery M, and Bawa S (2019) ‘Why do home-owners do better?’ Conference paper presented at State of Australian Cities Conference and PhD Symposium, Perth, Western Australia.

Enarson EP (2012) Women confronting natural disaster: From vulnerability to resilience, Lynne Rienner Publishers, Boulder, CO.

Ferrer-i-Carbonell A, and Frijters P (2004) ‘How important is methodology for the estimates of the determinants of happiness?’, The Economic Journal, 114(497): 641-659.

Frey BS and Stutzer A (2002) ‘What can economists learn from happiness research?’, Journal of Economic Literature, XL: 402-435.

Frey BS, Luechinger S, and Stutzer A (2009) ‘The life satisfaction approach to valuing public goods: The case of terrorism’, Public Choice, 138(3), 317-345.

Frijters P and Van Praag BM (1998) ‘The effects of climate on welfare and wellbeing in Russia’, Climatic Change, 39(1), 61-81.

Frijters P, Johnston DW, and Shields MA (2011) ‘Life satisfaction dynamics with quarterly life event data’, Scandinavian Journal of Economics, 113(1), 190-211.

Gardner J, and Oswald AJ (2006) ‘Do divorcing couples become happier by breaking up?’, Journal of the Royal Statistical Society: Series A (Statistics in Society), 169(2), 319-336.

Hazeleger T (2013) ‘Gender and disaster recovery: Strategic issues and action in Australia’, Australian Journal of Emergency Management, 28(2), 40-46.

Kahneman D, Wakker PP, and Sarin R (1997) ‘Back to Bentham? Explorations of experienced utility’, The Quarterly Journal of Economics, 112(2), 375-406.

Kimball M, Levy H, Ohtake F and Tsutsui Y (2006) Unhappiness after Hurricane Katrina, National Bureau of Economic Research Working Paper 12062.

Lucas RE, Clark AE, Georgellis Y, and Diener E (2004) ‘Unemployment alters the set point for life satisfaction’, Psychological Science, 15(1), 8-13.

Lucas RE, and Clark AE (2006) ‘Do people really adapt to marriage?’, Journal of Happiness Studies, 7(4), 405-426.

Luechinger S and Raschky PA (2009) ‘Valuing flood disasters using the life satisfaction approach’, Journal of Public Economics, 93(3-4), 620-633.

Metcalfe R, Powdthavee N and Dolan P (2011) ‘Destruction and distress: Using a quasi-experiment to show the effects of the September 11 attacks on mental wellbeing in the United Kingdom’, The Economic Journal, 121(550), F81-F103.

Oswald AJ, and Powdthavee N (2008) ‘Does happiness adapt? A longitudinal study of disability with implications for economists and judges’, Journal of Public Economics, 92(5-6), 1061-1077.

Parida PK (2015) ‘Natural disaster and women’s mental health’, Social change, 45(2), 256-275.

Rehdanz K and Maddison D (2005) ‘Climate and happiness’, Ecological Economics, 52(1), 111-125.

Rehdanz K, Welsch H, Narita D, and Okubo T (2015) ‘Wellbeing effects of a major natural disaster: The case of Fukushima’, Journal of Economic Behavior & Organization, 116, 500-517.

Ren H, Folmer H and Van der Vlist AJ (2018) ‘The impact of home ownership on life satisfaction in urban China: A propensity score matching analysis’, Journal of Happiness Studies, 19, 397–422.

Thunberg E and Shabman L (1991) ‘Determinants of landowners’ willingness-to-pay for flood hazard reduction’, Water Resources Bulletin, 27(4), 657-665.

Thurston AM, Stöckl H and Ranganathan M (2021) ‘Natural hazards, disasters and violence against women and girls: A global mixed-methods systematic review’, BMJ global health, 6(4), e004377.