We describe our results from analysing household consumption as a whole and by GST status. We also discuss consumption trends across the broad commodity categories.

5.1 Since the introduction of the GST

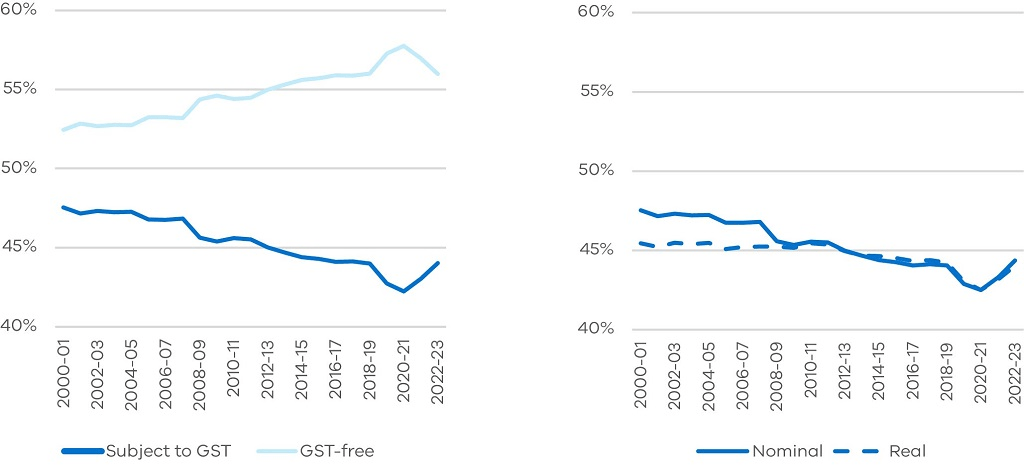

Figure 4 depicts the trends of GST-able and GST-free consumption over time. It can be seen that since July 2000, there has been a steady decline in the share of household consumption that was subject to GST ('GST-able'). At the same time, the relative share of GST free household consumption has increased over time. In the first decade (2000-2009), analysis reveals that the share of nominal household consumption subject to GST declined while real household consumption subject to GST remained flat. This observation suggests that the key driver of the decline in nominal terms was relatively stronger growth in the prices of goods and services that are GST-free. In the next decade, Australian households appears to have begun purchasing a greater share of GST-free goods and services (in real terms), contributing to the decline in the share of GST-able household consumption.

One possible explanation for this observed trend is movement in the exchange rate. As is known, the price of imports plays an important role in GST collections, with GST collected on imports accounting for around 50 per cent of total GST.1 In this case, during the early years of the GST, a rising Australian dollar caused import prices to fall, causing the relative share in the price of goods and services subject to GST to decline. This contributed to a decline in the share of nominal household consumption subject to GST over the first decade of the century, while the share in real household consumption of goods and services remained flat.

Meanwhile, the onset of the COVID-19 pandemic in Australia in March 2020 brought about significant changes in household consumption patterns. It is clear from the diagram that the share of GST-able household consumption followed a U-shaped (or V-shaped) trajectory, indicating that the pandemic had a two-part effect on consumption patterns: one which saw an acceleration of the pre-pandemic trend, followed by a divergence from the pre‑pandemic trend (see Figure 4).

Figure 4: Annual share of total household consumption by GST status (%)

Note: Excludes GST from private gross fixed capital formation (private investment), which is around 25 per cent of total GST.

Source: DTF analysis of ABS data.

5.2 Before the onset of the COVID-19 pandemic

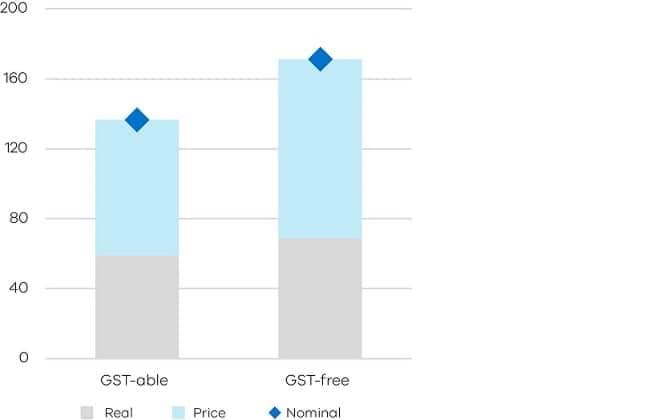

The share of GST-able household consumption declined steadily over the pre-pandemic period. This was driven by a combination of relatively lower price2 and real consumption growth for GST-able items at different stages of the two decades leading up to the onset of the COVID-19 pandemic. Over this period, household consumption that is GST-free grew by around 34 percentage points more than spending on GST-able goods and services (see Figure 5).

Figure 5: Percentage change in household consumption since the introduction of the GST to December 2019 by GST status

Source: DTF analysis of ABS data.

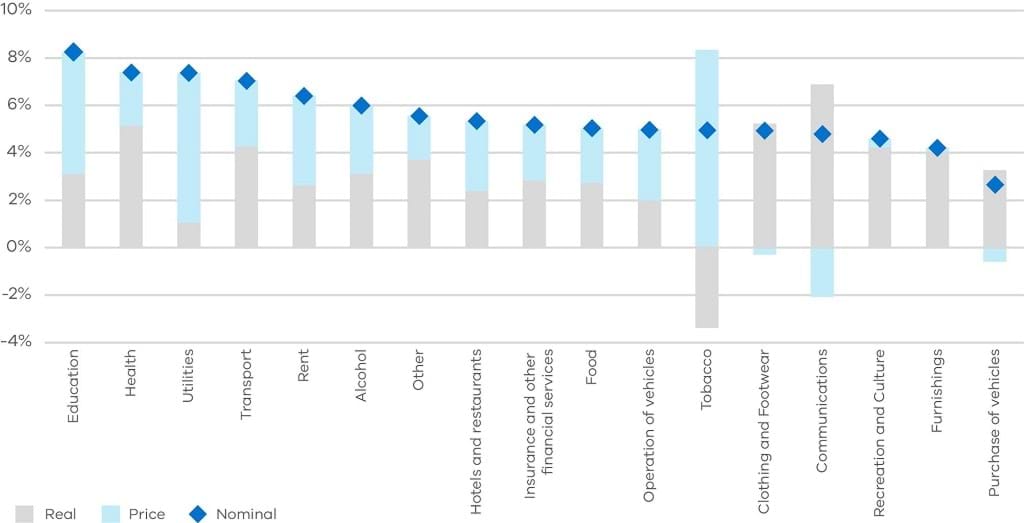

High pre-pandemic growth at the category level was headlined by mostly GST-free categories in education, health, and rent - all among the five fastest growing categories. Utilities, transport, and alcohol consumption were amongst the strongest growing mostly GST-able items. However, these categories represent a smaller share of household consumption, particularly utilities and alcohol consumption, which represent 2.4 and 2.0 per cent of total household consumption, respectively. The categories experiencing the lowest growth rates mainly comprised of mostly GST-able items, which experienced low price growth (some negative) (see Figure 6).

Figure 6: Household consumption expenditure, average annual growth (%), 2000-01 to 2018-19

Source: DTF analysis of ABS data, inspired by the PBO report into structural trends in GST (2020).

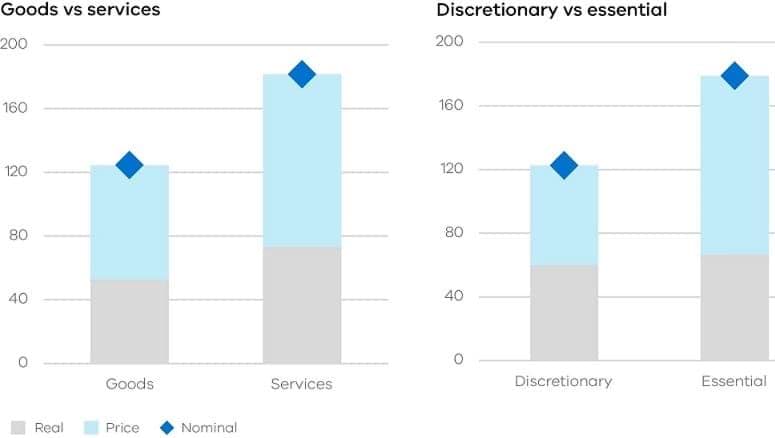

Over the two decades leading up to the COVID-19 pandemic, spending on services and essential items significantly outpaced the growth in the consumption of goods and discretionary items. Services consumption outpaced 'goods' consumption by almost 50 percentage points, driven primarily by relatively stronger price growth. A similar pattern was observed with essential consumption outpacing discretionary spending (see Figure 7).

This supports the steady decline in the share of GST-able household consumption over this period, as it primarily consists of goods and discretionary spending, which experienced slower growth.

Figure 7: Percentage change (%) in household consumption since the introduction of the GST to Dec 2019, goods vs services

Source: DTF analysis of ABS data.

5.3 Since the onset of the COVID-19 pandemic

In terms of the consumption patterns of Australian households, the COVID-19 pandemic period can be broken down into two phases: the first was characterised by necessary public health restrictions leading up to the September quarter 2021, then the second, the post-lockdown phase where these restrictions were eased.

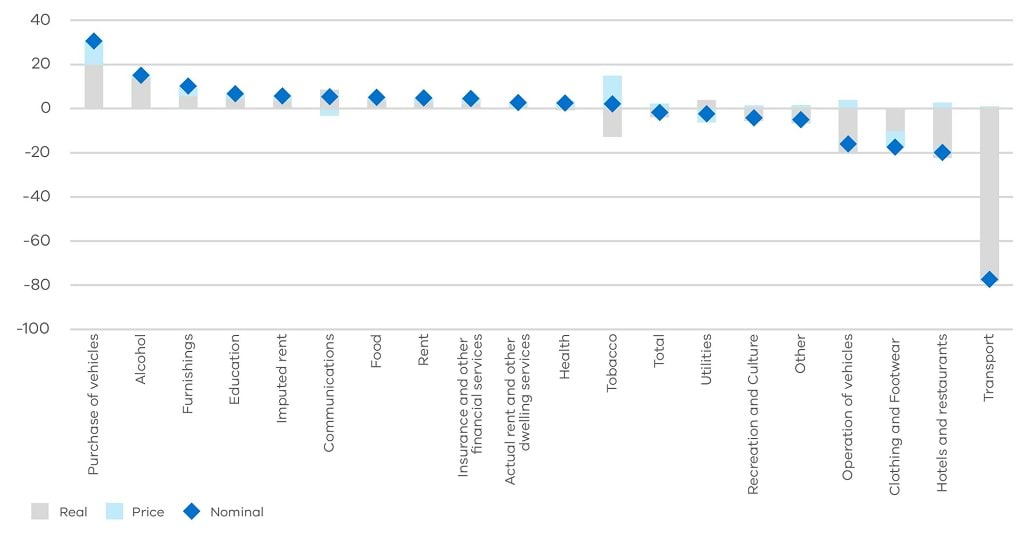

Necessary public health measures enforced in Australia resulted in a significant reduction in travel and tourism-related consumption, as evidenced by large falls in the real consumption of 'hotels and restaurants' and 'transport' (which includes air travel). In-person activities were also limited or restricted, leading to declines in the real consumption of recreational and cultural activities. On the flip side, with households being limited in the consumption of some items, other categories experienced high rates of growth, including the purchase of vehicles (which exhibited the weakest growth pre‑pandemic), alcohol and home improvement consumption (as measured by the furnishing category) (see Figure 8).

The overall impact of these consumption patterns resulted in a sharp decline in the share of GST-able household consumption in the lead-up to the September quarter 2021.

Figure 8: Percentage change since the onset of the COVID-19 pandemic to the September quarter 2021

Source: DTF analysis of ABS data.

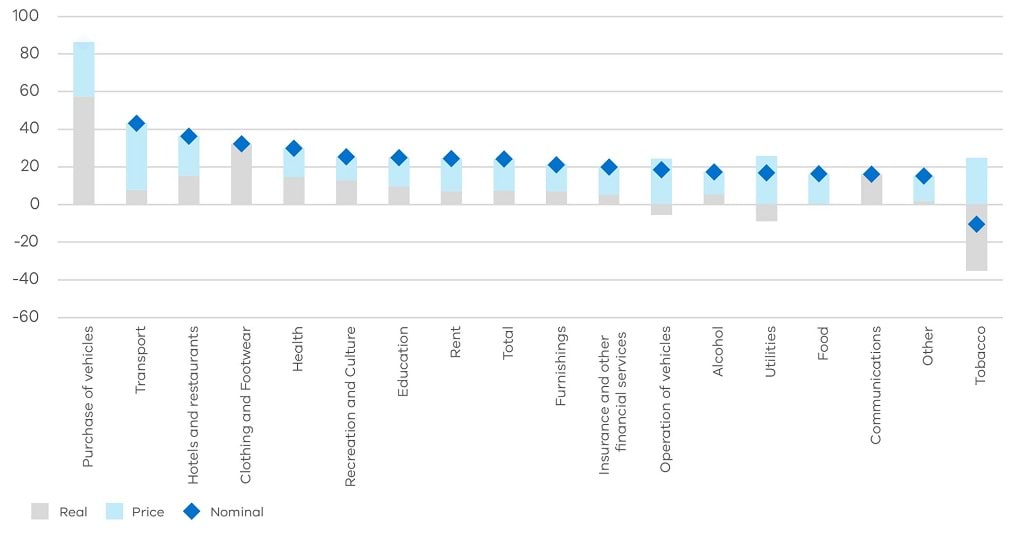

As restrictions began to ease across Australia, household consumption patterns shifted, resulting in a sharp increase in the share of GST-able household consumption. This increase represented the most significant rise since the GST was introduced. The increase was largely driven by a wave of spending on previously restricted consumption categories such as hotels and restaurants, transport, and recreation and culture, all of which have grown by more than 25 per cent compared to pre-pandemic levels. Growth in mostly GST-free items such as health, rent, and education has been strong but relatively subdued compared to the GST‑able items previously mentioned.

Some other trends in household consumption show that rising inflation has caused broad-based price growth across most categories. For example, food consumption3 has grown by around 15 per cent relative to the pre-pandemic period and is almost entirely driven by rising prices. Additionally, the purchase of vehicles has been an emerging consumption pattern of the COVID-19 pandemic period (which exhibited the weakest growth pre-pandemic), growing strongly in both phases of the COVID-19 pandemic period. At present, the purchase of vehicles is almost double pre-pandemic levels, driven by an increase of around 60 per cent in real consumption and 30 per cent in prices (see Figure 9).

Figure 9: Percentage change since the onset of the COVID-19 pandemic to the December 2023 quarter

Source: DTF analysis of ABS data.

Relative to the onset of the COVID-19 pandemic and up until the December quarter of 2023, growth in GST-able and GST-free household consumption has been broadly the same. However, their trajectories over the course of the COVID-19 pandemic are different. GST-able household consumption was more adversely affected by COVID-19 public health measures, as evidenced by deeper troughs compared to GST-free consumption.

This can be explained by the composition of items in each category. GST-free items include the consumption of food, health, rent, education, financial services, and the purchase of vehicles. It is clear that these consumption items were less affected by necessary public health restrictions compared to the GST-able categories such as transport and hotels and restaurants.

Interestingly, recent household consumption patterns show signs that spending on GST-able goods and services has begun to slow, as reflected by a slowdown in real terms household consumption subject to GST (see Figure 10). This would suggest a reversion towards the pre-pandemic trend of a declining share of GST-able household consumption (see Figure 4).

Figure 10: Household consumption growth since the COVID-19 pandemic, by GST-able and GST-free, index March 2020 = 100

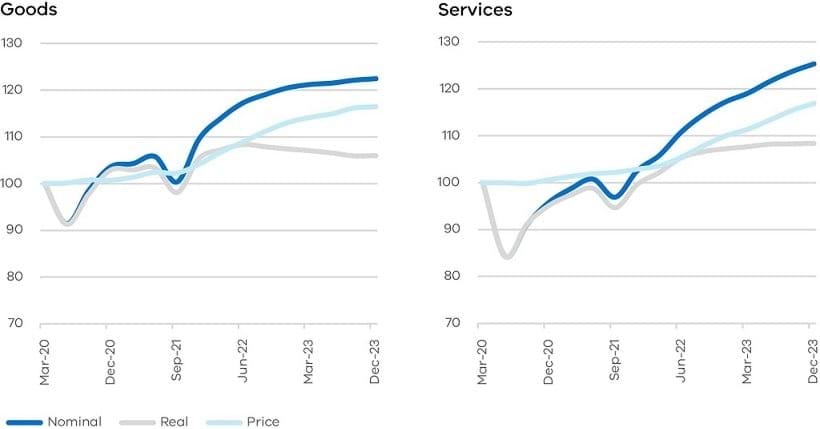

Growth in consumption of ‘goods’ and ‘services’ relative to pre-pandemic has has grown at almost equal rates to the December quarter 2023. Over the first phase of the COVID-19 pandemic, services household consumption experienced a larger decline than spending on goods, largely due to the enforced border restrictions which limited the consumption of tourism related services.

As necessary public health restrictions eased over the second phase since the onset of the COVID-19 pandemic, strong price growth contributed to increases in the consumption of both goods and services. In recent quarters, there are signs that Australian households are moderating their overall consumption (in real terms) in response to a challenging economic environment. Most notably, the real consumption of goods has begun to decline, contributing to a slow down in the real household consumption of GST-able items (see Figure 11).

Figure 11: Household consumption growth since the COVID-19 pandemic, goods, index March 2020 = 100

Source: DTF analysis of ABS data.

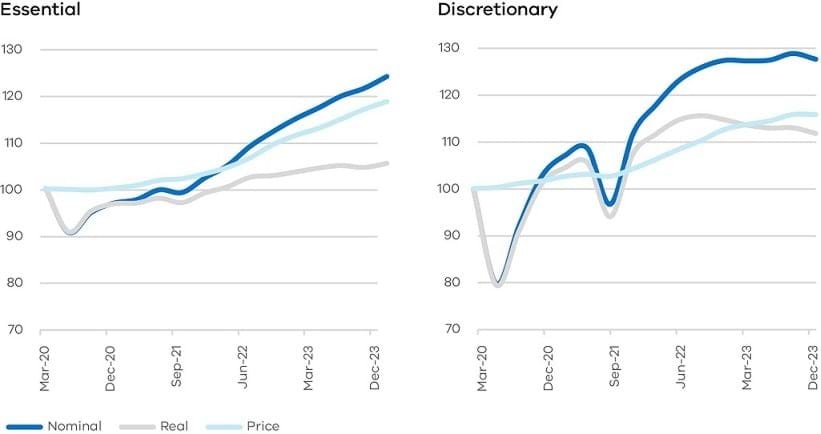

Growth in spending on discretionary items relative to the onset of the COVID-19 pandemic and up until the December quarter 2023 remains elevated compared to essential consumption. Strong expenditure on discretionary household consumption has been a key reason for the share of GST-able household consumption rise over the two years since COVID-19 pandemic restrictions eased.

However, data in recent quarters suggest that Australian households may have started to pull back on discretionary expenditure, which would place downward pressure on the share of GST-able household consumption (see Figure 12).

Figure 12: Household consumption growth since the COVID-19 pandemic, essential, index March 2020 = 100

Source: DTF analysis of ABS data.

Footnotes

[16] Parliamentary Budget Office (2020) report into Structural Trends in GST.

[17] Prices are an approximation and do not represent actual CPI.

[18] Refers to food purchased by households mainly for consumption or preparation at home.

Updated